By Milton Kirby | Atlanta, GA | January 10, 2026

Americans who rely on Social Security and Medicare entered 2026 facing a series of significant changes that will shape monthly incomes, health care costs, taxes, and access to prescription drugs. From a higher cost-of-living adjustment to the long-awaited launch of negotiated Medicare drug prices, the updates reflect both inflation pressures and years of policy debate.

Here is a breakdown of the most important changes now in effect.

Higher Social Security Payments, Modest but Meaningful

Social Security recipients received a 2.8 percent cost-of-living adjustment (COLA) on January 1, reflecting rising inflation late last year. That increase is slightly higher than the 2.5 percent COLA granted in 2025.

According to the Social Security Administration, the average monthly retirement benefit rises by about $56, from roughly $2,015 to about $2,071. While not dramatic, the increase offers some protection against rising food, housing, and medical costs.

Medicare Premiums and Deductibles Rise Sharply

Medicare enrollees are seeing steeper increases.

- Medicare Part B premiums climbed nearly 10 percent, rising to $202.90 per month, up from $185 in 2025.

- The Part B deductible increased to $283, up from $257.

- The Part A inpatient deductible is now $1,736, compared with $1,676 last year.

These increases mean many seniors will see a noticeable portion of their COLA absorbed by health care costs.

Higher Payroll Taxes for Top Earners

Workers continue to pay 12.4 percent of earnings toward Social Security—split evenly between employees and employers, or fully paid by the self-employed. In 2026, however, the maximum amount of earnings subject to that tax increased to $184,500, up from $176,100 in 2025.

The change affects higher-income workers most directly, modestly strengthening Social Security’s funding base.

New Tax Break for Older Americans

A new federal tax deduction aimed at older adults also took effect this year. Eligible taxpayers 65 and older can now reduce taxable income by up to $6,000, or $12,000 for married couples.

The deduction phases out for individuals earning more than $175,000 and couples earning more than $250,000. The provision was backed by AARP and included in the One Big Beautiful Bill Act passed last summer.

Earnings Test Adjustments for Working Beneficiaries

For Social Security beneficiaries who have not yet reached full retirement age—now between 66 and 67—the earnings test threshold also increased.

In 2026, beneficiaries who will not reach full retirement age during the year will have $1 withheld for every $2 earned above $24,480, up from $23,400 in 2025. Once full retirement age is reached, the earnings test no longer applies.

Higher Threshold to Earn Social Security Credits

Workers still need 40 Social Security credits to qualify for retirement benefits, earning up to four credits per year. In 2026, the income needed to earn one credit increased.

You now earn one credit for every quarter in which you make at least $1,890 in taxable earnings, about $80 more per quarter than last year.

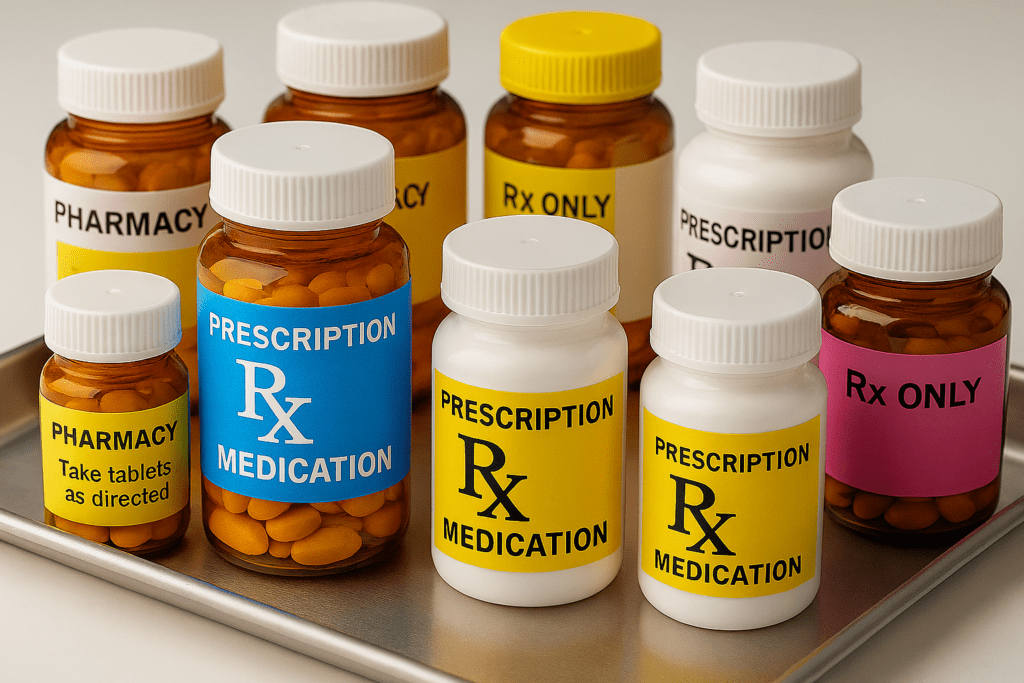

Weight-Loss Drugs Poised for Medicare Breakthrough

Beyond core benefits, one of the most closely watched developments involves GLP-1 weight-loss medications.

Roughly 32 million American adults have used GLP-1 drugs, including about one-fifth of women ages 50 to 64, according to a recent report by RAND Corporation. Monthly prescriptions often exceed $1,000, placing them out of reach for many seniors.

A deal announced last fall between the Trump administration and manufacturers Eli Lilly and Novo Nordisk promises sharply lower prices through a new direct-to-consumer platform called TrumpRx, expected to launch in early 2026.

Officials say prices could fall to about $350 per month through TrumpRx. If the oral GLP-1 drug orforglipron receives approval from the U.S. Food and Drug Administration, it would be priced similarly. An initial pill version of Wegovy could cost as little as $150 per month, pending approval.

Under Medicare, officials estimate GLP-1 prices could average $245 per month, with typical copays around $50, a dramatic reduction if fully implemented.

Medicare Drug Price Negotiations Finally Begin

Another landmark change arrived quietly on January 1: the first 10 Medicare Part D drugs with negotiated prices officially became available.

After Congress passed a law in 2022 requiring negotiations between drugmakers and the federal government, the Centers for Medicare & Medicaid Services finalized prices that slash costs for some of the most widely used medications.

Savings are substantial. For a 30-day supply:

- Januvia $527 $113 79% reduction

- Eliquis $521 $231 56% reduction

- Jardiance $573 $197 66% reduction

- Enbrel $7,106 $2,355 67% reduction

- Jardiance $197 $573 66% reduction

- Stelara $4,695 $13,836 66% reduction

- Xarelto $197 $517 62% reduction

- Eliquis $231 $521 56% reduction

- Entresto $295 $628 53% reduction

- Imbruvica $9,319 $14,934 38% reduction

Advocates say the move represents the most significant shift in Medicare drug pricing since the program’s creation.

A Year of Tradeoffs

Taken together, the 2026 changes deliver both relief and new pressures for older Americans. Monthly Social Security checks are larger, tax breaks are broader, and drug prices are finally falling—but Medicare premiums and deductibles continue to climb. For seniors living on fixed incomes, 2026 may be remembered less as a year of sweeping reform than one of careful tradeoffs, where every increase comes with a corresponding cost.

Thank you for reading. If this reporting matters to you, consider subscribing to The Truth Seekers Journal and supporting independent, community-focused journalism.